In today's fast-paced world, efficiency and transparency are crucial in every industry, and the insurance sector is no exception. One of the biggest challenges insurance companies face is streamlining their claims process while ensuring accuracy, security, and efficiency. Enter Hyperledger Blockchain Development Services — a game-changer for automating insurance claims. In this post, we'll explore how Hyperledger Blockchain can revolutionize the way insurance claims are handled, making the process faster, more secure, and cost-effective.

What is Hyperledger Blockchain?

Before diving into the details, let’s quickly clarify what Hyperledger Blockchain is.

Hyperledger is an open-source project that provides a set of tools for building private, permissioned blockchain networks. Unlike public blockchains like Bitcoin or Ethereum, Hyperledger is designed to meet the needs of businesses, particularly those in industries like insurance, healthcare, and finance. It enables organizations to create secure and scalable blockchain networks to improve transparency and automate processes.

For insurance companies, Hyperledger Blockchain offers several benefits, particularly when it comes to claims automation. But how exactly does it work, and why is it such a powerful tool for the industry? Let’s take a closer look.

The Challenges in Insurance Claims Processing

Before we talk about how Hyperledger solves the problems, let's first examine the common issues faced by insurance companies in claims processing:

- Slow processing times: Manual claim handling takes time. Delays lead to unhappy customers and increased operational costs.

- Fraud risk: Fraudulent claims are an ongoing challenge in the insurance industry. Detecting and preventing them can be difficult.

- Lack of transparency: Traditional insurance processes can be opaque, leaving policyholders in the dark about the status of their claims.

- High operational costs: The administrative overhead for processing claims is significant, adding to the overall cost of doing business.

How Hyperledger Blockchain Can Transform Insurance Claims

Now, let’s explore how Hyperledger Blockchain Development Services can automate and streamline the entire insurance claim process.

1. Speeding up the Claims Process

Hyperledger Blockchain eliminates the need for intermediaries in the claims process. Claims data can be shared securely and instantly between all parties involved — insurers, claimants, and third-party validators. This significantly reduces the time it takes to process a claim, from days or weeks to mere minutes.

Example: Imagine an insurance company using Hyperledger Blockchain for car accident claims. Once a claim is filed, the data is immediately shared with the relevant stakeholders — like the repair shop and the police — ensuring that all parties have access to the same, up-to-date information in real time. This quick, seamless exchange speeds up the settlement process.

2. Increasing Transparency and Trust

One of the key features of Hyperledger Blockchain is its transparency. Every transaction made on the blockchain is recorded in a public ledger, which can be accessed by authorized parties. This creates a clear, immutable record of the entire claims process, making it easy for both insurers and policyholders to track the progress of claims.

Example: In a healthcare insurance scenario, a patient can check the status of their claim directly on the blockchain, knowing that the information is accurate and up to date. There’s no room for doubt or confusion, which helps build trust between the insurance company and its clients.

3. Reducing Fraud

Blockchain's secure, immutable ledger makes it much harder for fraudulent claims to slip through the cracks. Once a claim is recorded on the blockchain, it can’t be altered or tampered with. This greatly reduces the possibility of fraudulent claims, as all data is verified and stored securely.

Example: Let’s say an insurance company is handling a car accident claim. Using blockchain, the insurance provider can cross-check the claimant’s data, such as accident reports or medical records, against previous claims to ensure there’s no history of fraudulent activity.

4. Cutting Down on Operational Costs

By automating the claims process with Hyperledger Blockchain Development Services, insurance companies can reduce the time and labor required to handle claims manually. This leads to fewer errors, lower administrative costs, and more efficient operations overall. The saved costs can be passed on to the policyholder or reinvested into improving other parts of the business.

Example: A typical insurance claim involves paperwork, phone calls, emails, and manual data entry. With Hyperledger, most of this can be automated, drastically cutting down on the time spent on each claim.

How Hyperledger Fabric Facilitates Claims Automation

Hyperledger Fabric, one of the most widely used frameworks within the Hyperledger project, is ideal for automating insurance claims. It allows businesses to build permissioned networks, which means that only authorized parties can access sensitive data. Let’s break down how Hyperledger Fabric can enhance insurance claims automation:

Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. In insurance claims, smart contracts can automatically trigger actions when predefined conditions are met. For example, once an accident is verified by the police, the smart contract could automatically trigger a payment to the claimant without any human intervention.

Integration with Existing Systems

Hyperledger Fabric can be integrated with an insurance company’s existing IT systems. Whether it’s a legacy claims management system or an advanced customer service portal, Hyperledger Blockchain Development Services can connect the new blockchain network to the old one, ensuring a smooth transition and minimal disruption to ongoing operations.

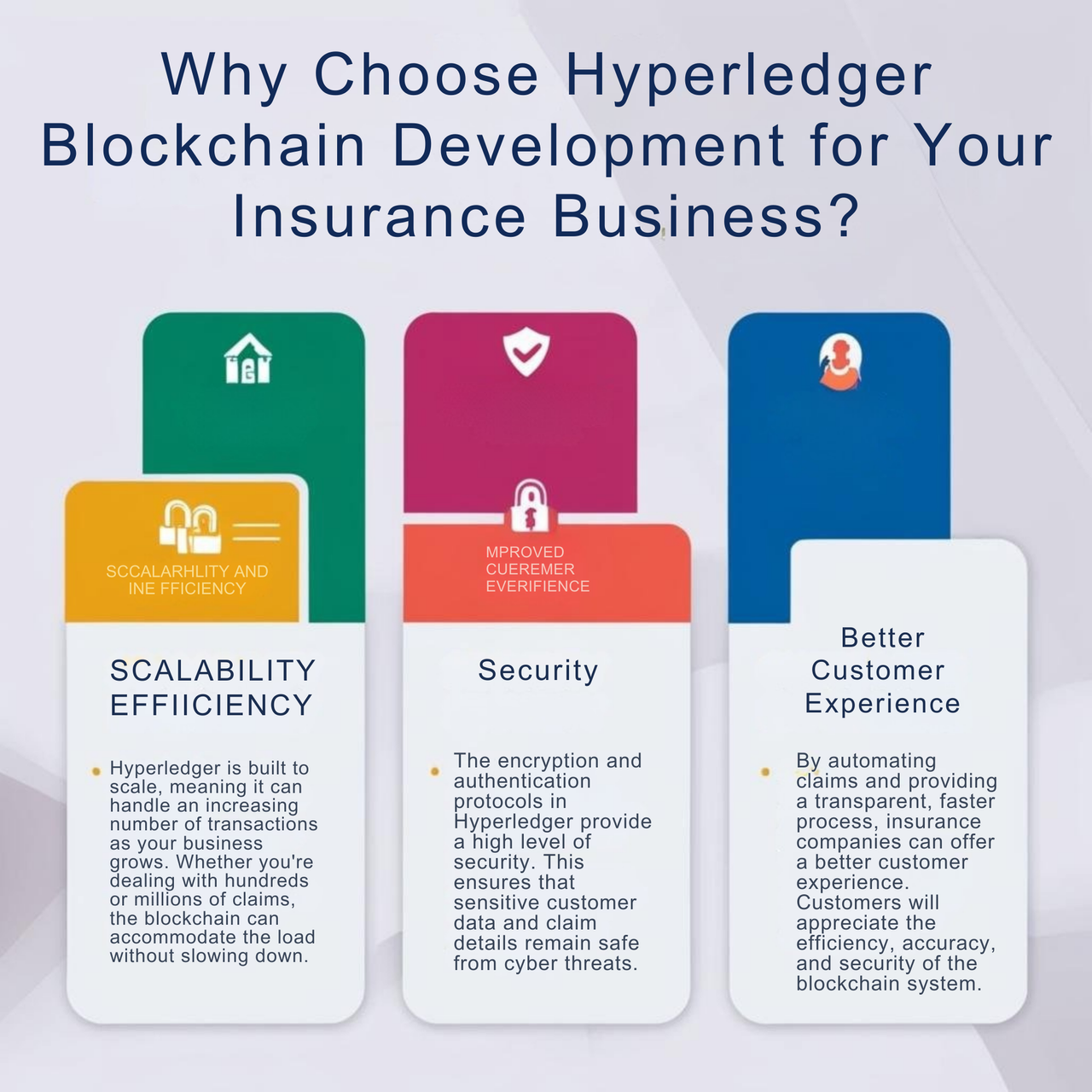

Why Choose Hyperledger Blockchain Development for Your Insurance Business?

1. Scalability and Efficiency

Hyperledger is built to scale, meaning it can handle an increasing number of transactions as your business grows. Whether you're dealing with hundreds or millions of claims, the blockchain can accommodate the load without slowing down.

2. Security

The encryption and authentication protocols in Hyperledger provide a high level of security. This ensures that sensitive customer data and claim details remain safe from cyber threats.

3. Better Customer Experience

By automating claims and providing a transparent, faster process, insurance companies can offer a better customer experience. Customers will appreciate the efficiency, accuracy, and security of the blockchain system.

How to Get Started with Hyperledger Blockchain Development for Insurance

1. Partner with the Right Development Team

Choosing the right Hyperledger Blockchain development services provider is crucial. Look for a development team with expertise in both blockchain technology and the insurance industry.

2. Assess Your Needs

Before starting development, carefully assess your current claims process. Identify pain points that can be addressed through automation and blockchain technology.

3. Plan for Integration

If you already have an existing claims system, plan how you will integrate the blockchain with your current infrastructure. This may involve working with your IT department or outside consultants to ensure a smooth transition.

4. Start with a Pilot Program

Consider launching a pilot program for a specific type of insurance claim, such as health or auto insurance, before fully rolling out the blockchain solution. This allows you to test the system and make improvements before a company-wide implementation.

Final Thoughts

Incorporating Hyperledger Blockchain Development Services into your insurance company can be a transformative step toward automating claims and improving overall operational efficiency. By leveraging Hyperledger’s security, scalability, and transparency, you can not only enhance customer satisfaction but also reduce fraud and administrative costs. The future of insurance claims is digital, and Hyperledger Blockchain is leading the way.

If you're ready to unlock the power of blockchain for your insurance claims, now is the time to explore Hyperledger Blockchain Development Services. Take the first step today and join the wave of companies revolutionizing their business processes with blockchain technology. Reach out to our team for a consultation to discuss how we can help you integrate Hyperledger Blockchain into your claims process, streamline your operations, reduce costs, and enhance customer trust with this cutting-edge solution.